Save the Farms: Nonlinear Impact of Climate Change on Banks’ Agricultural Lending

By Ted Liu

Abstract

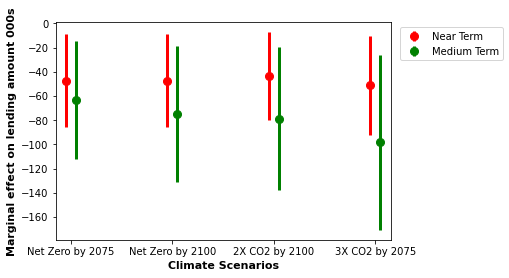

The agricultural sector is particularly susceptible to the impact of climate change, both in terms of production and access to bank financing. This paper contributes to the literature by investigating how vulnerability to climate change affects U.S. farms’ credit access, using a novel panel dataset at county level and at bank level. The results show that increasing exposure to climate change can reduce bank lending to farms, and such impact is nonlinear. Additionally, while the contemporaneous effects are significant, the impact of climate change on bank lending also materializes over time. While the overall effects are negative, more granular analysis suggests that different farm groups fare differently. With growing vulnerability to climate change, small to medium farms almost always experience some loss of loan access and funding. In comparison, large farms see less severe credit contraction, and in some cases may even see improvement in funding. While such patterns hold for the United States as a whole, there is heterogeneity of impact depending on farm regions, income areas, and the types of banks providing the lending.

Access

Presentations

- UC Santa Cruz Postdoc Symposium, Santa Cruz, May 2022

- Office of the Comptroller of the Currency (OCC) Symposium on Climate Risk in Banking and Finance, Washington DC, June 2022

- Graduate Climate Conference (poster), Seattle, October 2022

Grants

- Hammett Fellowship on Climate Change

- Food System Research Fund